US Dollar under pressure

- Dr. Roelof Botha

- Apr 6, 2023

- 2 min read

Updated: Feb 13

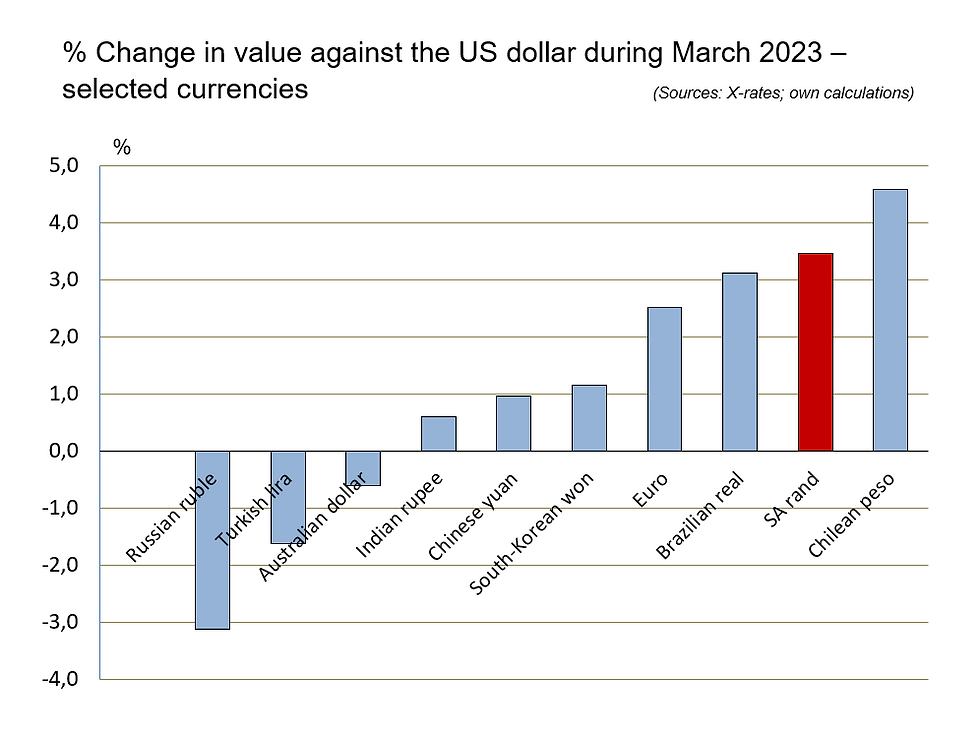

During March, the fortunes of the US dollar took a turn for the worse, with virtually every currency of note gaining lost ground against the greenback. Reasons for the dollar’s sharp contraction in March were mainly related to a gradual return of risk-on sentiment amongst global fund managers.

Between the 2nd and 24th of March, the yield on 10-year US bonds declined by 71 basis points, providing impetus to the renewed investor appetite for higher-yielding assets.

At the end of March, most US equities were headed for a winning quarter, with the S&P 500 and the Nasdaq 100 having gained more than 5% and almost 15%, respectively, since the beginning of the year. On 29 March, the Nasdaq 100 closed 20% higher than its December low, officially triggering the start of a new bull market.

These feats were achieved despite lingering economic uncertainty and unexpected nervousness about the stability of banks that possess large holdings of US treasuries.

The latest US Personal Consumption Expenditures Index, which is regarded as the Federal Reserve’s preferred gauge of inflation, only rose 0.3% (in February), against market expectations of a 0.4% increase. The fact that inflation is moving in the right direction has also incentivised the switch to investments in riskier assets.

Pressure on the US dollar is likely to continue, mainly due to signs that the Federal Reserve’s rate-hike cycle is about to end. According to Reuters, federal funds futures have priced in a 65% chance of another 25 basis-point US rate hike in May, but no increase in June. Futures traders have also factored in rate cuts before the end of the year.

Another pressure point is the huge trade deficit, which is related to the strength of the US dollar during the first nine months of 2022. After an average deficit of around $75 billion between 2018 and 2021, the deficit leaped to an average of $93 billion since April 2022.

A stronger rand will undoubtedly assist efforts to curb inflation, which is fortunately already on a downward trajectory, albeit relatively slow. Prospects for lower inflation have nevertheless been tempered somewhat by the reversal of the consistent oil price decline since the end of March.

The Opec+ group of oil producers, which include the 2nd, 3rd and 5th largest oil producers in the world (Russia, Saudi Arabia and Iraq, respectively) have decided to cut supplies by 1.5 million barrels of oil per day, ostensibly in an effort to stabilise the oil market.

Oil prices have remained fairly volatile, but the move by Opec+ was probably triggered by a 43% reduction in the oil price (West Texas Intermediate - WTI) between June last year and mid-March 2023. Unfortunately for non-oil producing countries, the WTI crude price has since risen by 19%, back to a level above $80 per barrel.

With non-Opec+ countries still supplying around 60% of global oil production and sluggish economic growth in most of the advanced economies, the oil price, like the US dollar, may remain under pressure during the 2nd quarter of 2023.